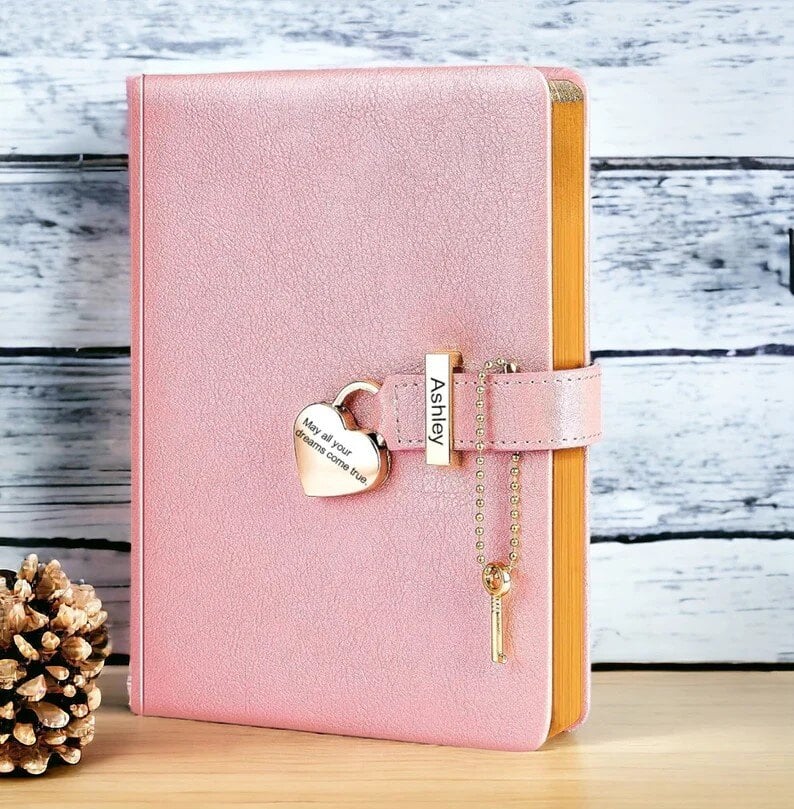

Tax reform is on a fast track for a vote before Christmas. There are many details in the House and Senate versions to be reconciled. Four major proposals could potentially affect the ministry of United Church Homes and the lives of older adults:

- Elimination of medical expense deduction on Schedule A. Many of our residents rely on this offset to their bills for assisted living and skilled nursing care.

- Elimination of private activity bonds and advance refunding of bonds. We use tax exempt bond financing and have used advance refunding so that we can leverage favorable interest rates for long term financing of projects.

- Reduction of the charitable contribution allowance to a cap set by the new greater standard deduction.

- Elimination of credits for state and local taxes paid.

Ohio senator appointed to conference committee

These may be changed or eliminated in conference committee. Sen. Portman has been an outspoken proponent of tax reform and has now been appointed to the conference committee. So, these issues will be in the hands of one of our state’s key leaders. Sen. Portman has proven largely intractable on changing his position despite continuing opposition from industry groups, the AARP, LeadingAge, the American Health Care Association and the American Hospital Association. He is determined to bring the bill to a successful vote.

Shifting financial stress to Medicare and Medicaid

The unknown issue beyond these detailed elements concerns the shift of financial risk represented in this reform. By eliminating the individual mandate and reducing the tax rates on corporations and the top 2 percent of earners, the federal government is capping its financial commitment to, among other things, Medicare and Medicaid. Not only will allowing healthy individuals to avoid buying into the program, but also cutting the key revenue streams supporting the ACA is likely to cause higher premiums for those who buy insurance but don’t qualify for subsidy.

Many states will be forced to choose between incurring high insurance costs amidst potential market changes as insurers exit the program. States will be pressured to raise taxes and reduce programs. This is one reason why the Ohio Assembly has been waiting to move on some of the governor’s vetoes. If Medicaid is significantly reduced, the Assembly is poised to make its own changes and cuts. So, tax reform is likely a first phase of eliminating the Affordable Care Act and beginning entitlement restructuring that LeadingAge believes will inevitably come in 2018.

Expect stress to HUD programs

Because the governing philosophy now is smaller federal government, we expect to face more cuts to HUD. United Church Homes currently provides homes through the HUD 202 program to 2,600 of the lowest income, most vulnerable older adults. This also impacts the press toward privatization of publicly funded programs like Medicare and Medicaid — which all of the residents of the HUD communities depend upon in addition to the many others in our health communities.

Low Income Housing Tax Credits

In addition, the government proposes reducing and eliminating Low Income Housing Tax Credits. This is meant to give over the development of housing to the private sector and be subject to free market forces.

Issues of Greatest Concern

The outlook for 2018 is stable for now, but unknown after the final version of tax reform appears. The issues of great concern now for United Church Homes are:

- Per capita Medicaid funding, putting nursing home residents at risk for reduced reimbursement

- Privatization of Medicare and Medicaid, putting large for-profit insurance companies in charge of rate contracting and quality control

- Status of tax exempt bond financing as a vehicle to invest in our campuses and growth for the future

- Uncertain status of nursing home regulation from 2017, which imposed greater costs for unfunded mandates

- Medicare rehab occupancy levels as market forces drive consumers and hospitals to reduce or avoid skilled post-acute care

- Reduced levels of support from donors if charitable deduction is limited or eliminated

- Accelerated state reductions to providers and shift of funding toward home and community services

- Further consolidations of healthcare insurers and providers such as the CVS-Aetna and the United Health Care-Devita Health mergers creating huge pools of insured lives further compressing rates as competition is reduced

I urge you to email or call Sen. Portman’s office if you are concerned as I am about any of these issues. Call the senator at 202.224.3353 (Washington office), 800.205.6446 (Columbus office), 513.684.3265 (Cincinnati office), 216.522.7095 (Cleveland office) or 419.259.3895 (Toledo office) or email him by visiting portman.senate.gov/public/index.cfm/contact-form.

A just world for all

The Advent season challenges us to wait expectantly and in hope for the One who can transform our lives from within and through us to transform God’s just world for all. This Advent is particularly troubled by international and national conflicts, endless wars and the distinct swing away from our country’s care for the poor.

As people of faith, we have to hold on to hope in the coming of the Christ and continue to speak truth to power on behalf of those we serve. United Church Homes was founded by those concerned about elder abuse, abandonment, poverty and access to long-term services and supports. Our heritage and our values today are still shaped by this deeply held conviction. When we create the experience of abundant life through programs and services that support community, wholeness and peace, we are working for a justice and ministering to those whom Christ said we should love.

This year, perhaps more than any other, our ability to continue to our mission is under stress. Please join me in reconnecting to our hope in our redeemer, our call to serve those in need and our witness to a just world for all.

View all articles by: