My husband died in 2004 when he was just 49 years old. Since then, I think I’ve had more than my share of “mortality thoughts,” the theme of this series of blog posts. It’s hard not to get a little obsessive about death and dying after someone who is close to you dies, I think.

At first, this took the shape of being hyper vigilant to potential health crises of my own. Slowly I began to trust my good health again and those thoughts subsided. In their place, I began to focus on my financial health and the financial responsibilities I had to my children. Central to that is the fact that I am continually grateful that my late husband was truly a planner. We lived within our means, we enrolled in retirement plans, we purchased life insurance. Because of that I was provided for in his death. He prepared for a disaster; when we had one I was more than provided for and my children and I were able to maintain our prior standard of living. The estate attorney from my husband’s law firm advised me to engage a financial planner which I did. Initially, Tom and I sat down periodically and I listened to his advice and continued in a pattern of protecting those assets for some future “emergency.” Eventually his advice included words like these, “it’s OK, Ruth, to spend some of this money.”

Out of that advice and also out of a sense that one of the shared values of our marriage was a commitment to supporting the common good, I began to think about how best to use my resources as I age and retire. And, it must be said, as I approach my own death.

Establishing Priorities and Values

It was a stroke of good fortune that about 6 years ago I was serving on the community board for a United Church Homes property here in Michigan. Because of that I learned about a process by which folks reevaluate (or establish) priorities for their estate planning. This was the perfect opportunity for me to seriously consider how to think “mortality thoughts” with a real and practical result. Though much of the work was done in the realm of financial assets and security and planning, I was guided to more fully discern and express the values of my life that I wanted to see continue in my death.

So, for about a year, once every month or six weeks, I met with a consultant, a guide to the process. He gave me specific tasks each time we met that all fit together into a final plan for reorganizing retirement benefits, developing a deeper understanding of my personal resources, honoring my desire to remember my late husband and enabling me to make significant contributions to organizations that are important to me. I knew I wanted to maximize charitable giving at my death, but I realized a much deeper commitment to living generously until I die. For me, this meant seriously considering how I might make a few larger contributions to organizations I love rather than many small donations each year, sometimes seemingly on a whim or at the tug of my heart.

Making End-of-Life Decisions

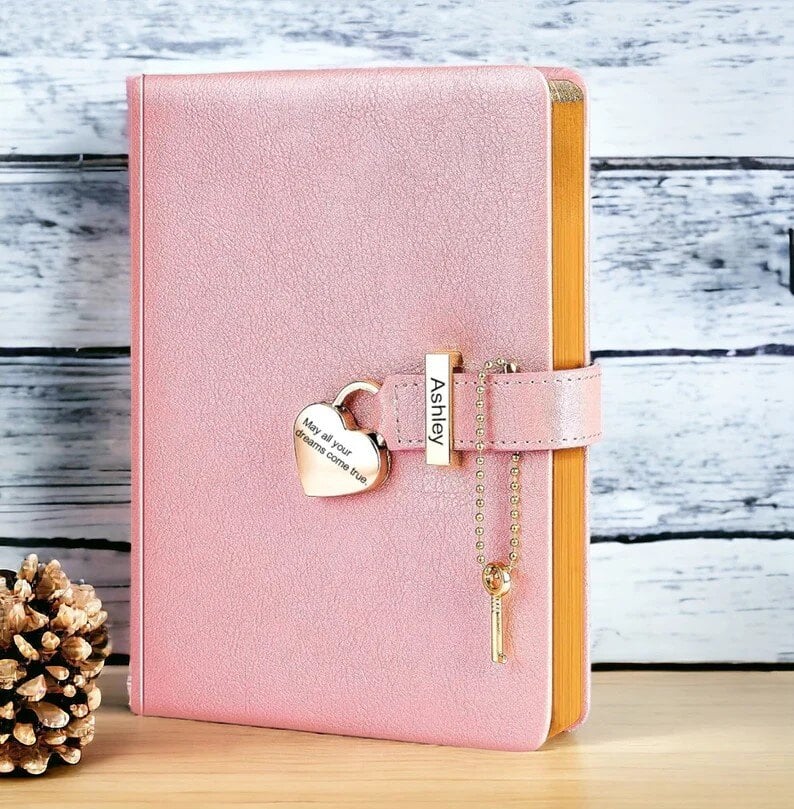

The process included making plans for many other aspects of the season we might call end-of-life. Making decisions about long-term care policies and an advanced directive for health care and talking to my family about these decisions along the way allowed us all to begin conversations about difficult topics. There are still a few things I have left to do to officially complete this process. I need to write a letter to each of my children and I must (that is a definite requirement) get a handle on my passwords for the technology and subscriptions. But these are manageable tasks and along with the “big” plans that are already in place, they come together into a life that provides ease and purpose and joy.

Recently I heard a quote attributed to the ancient stoics that pertains to mortality and freedom in life. It went something like this: “Keep your mortality in front of you and you will live a better life.” These plans have kept my mortality in front of me but they have also infused me with a sense of generosity and contentment in the work that was done and the effect it will have in the future.

These mortality thoughts are anything but morbid; they are life-giving and hopeful.

For Reflection (either individually or with a group)

Read the blog. Read it a second time, maybe reading it aloud or asking someone else to read it aloud so you can hear it with different intonation and emphases. Invite the Divine to open your heart to allow the light of new understanding to pierce the shadows of embedded assumptions, stereotypes, and ways of thinking so that you may live more abundantly. Then spend some time with the following questions together with anything or anyone who helps you reflect more deeply.

- What thoughts, if any, have you had about your own death? Do they involve fear or do they involve planning?

- What priorities or values are most important to you as you consider how you would like to manage the end of your life? Have you shared these with family or loved ones?

- How would you define a “good death”?

Download a pdf including the Reflection Questions to share and discuss with friends, family, or members of your faith community small group.

View all articles by: